New MTD Is Coming. Don’t Get Caught Scrambling.

- mveronese4

- Jan 6

- 2 min read

From April 2026, HMRC starts moving landlords, self-employed people and many contractors from “one tax return a year” to digital records + quarterly updates. If you wait until the last minute, you’ll be forced into rushed software, messy books, and avoidable penalties.

TaxHub makes you MTD-ready fast and keeps it running for you.

What’s changing (the part you actually need to know)

If you’re in scope for MTD for Income Tax (MTD ITSA), you’ll need to:

keep digital records using compatible software

send quarterly updates to HMRC

complete an end-of-year finalisation (tax still follows the usual Self Assessment cycle)

HMRC doesn’t give you the software, you either choose it yourself… or we set it up and manage it end-to-end.

Are you affected? (Most likely, yes.)

MTD ITSA is based on qualifying income = gross self-employment income + gross property income (before expenses).

Start dates:

6 April 2026 if you’re over £50,000

6 April 2027 if you’re over £30,000

Landlords: rents count.

Self-employed: turnover counts.

Contractors/CIS: if you’re self-employed (including CIS subcontractors), you’re in the same MTD boat, CIS continues, but your reporting becomes digital + quarterly.

The deadlines that trip people up

Quarterly updates are due about one month after each quarter end (typically 7 Aug, 7 Nov, 7 Feb, 7 May).

HMRC is also rolling out points-based penalties for late submissions. There’s a soft-landing for late quarterly updates in the first mandated year (2026/27), but annual submissions and payments still count so doing nothing is not a strategy.

Why TaxHub is the easiest way to win at MTD

MTD isn’t “more tax”, it’s more admin unless your system is clean. TaxHub turns it into a simple routine:

✅ MTD-ready setup (software, categories, bank feeds, rules)

✅ Quarterly updates done for you (no chasing, no confusion)

✅ Landlords + sole traders + CIS supported in one workflow

✅ Year-end finalisation + tax optimisation (not just compliance)

✅ Clear, fixed monthly support. No surprise fees

In short: you stay compliant, your numbers stay clean, and you stop wasting weekends on bookkeeping.

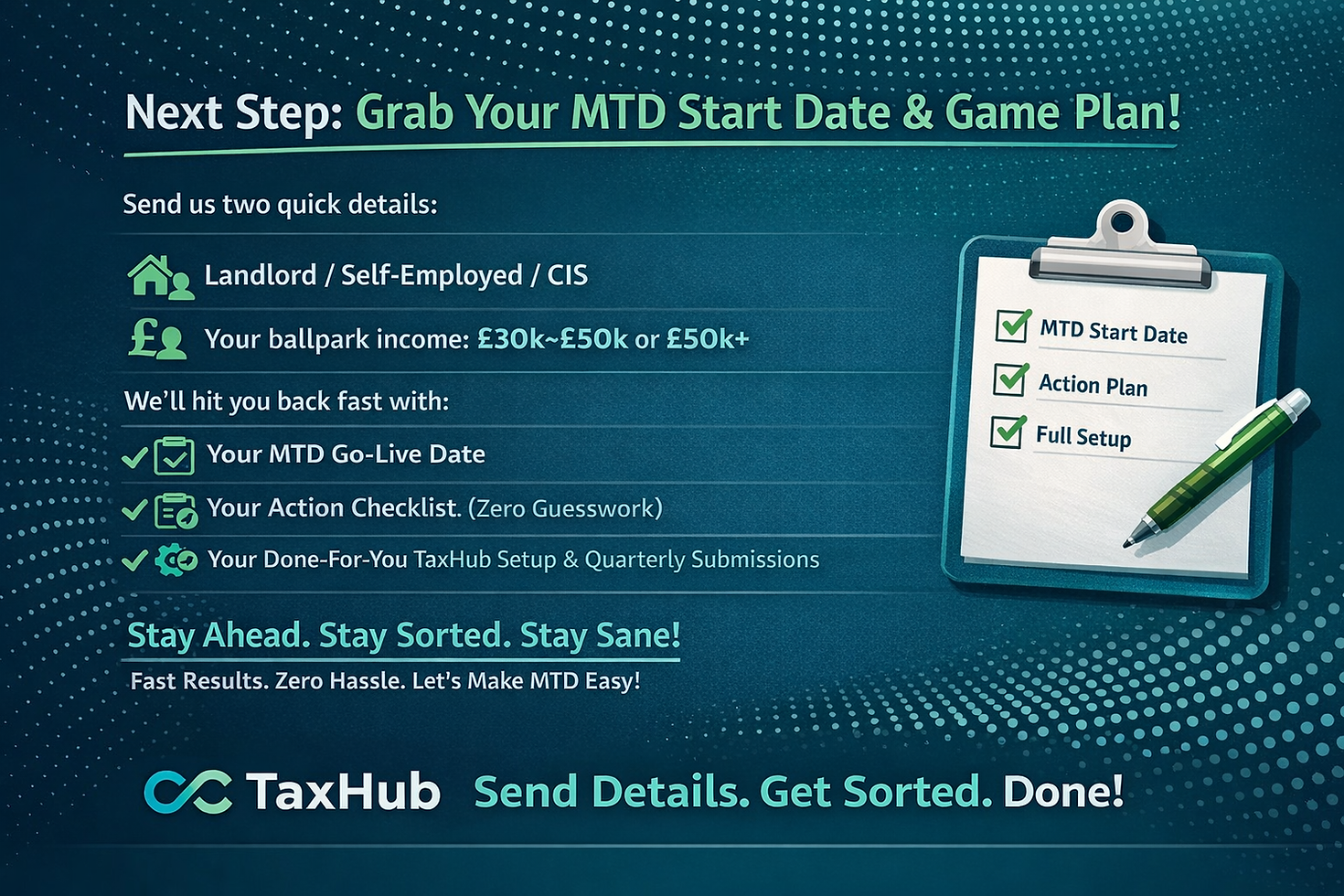

Next step (get your MTD start date + action plan)

Send us these two details:

Wheter you are a Landlord a Self-Employed or CIS Subcontractor

Your approx gross income: £30k–£50k or £50k+

…and we’ll come back with:

your MTD go-live date

a simple checklist of what you need

a done-for-you TaxHub plan to set everything up and handle the quarterly submissions

Fast. Clear. Fully managed.

Comments